There’s a quiet-but-undeniable shift happening across the franchise world, one that's fundamentally changing how brands approach their marketing and operations. We see it every day in our conversations with growth-stage brands and high-performing franchise networks.

The new wave of franchisees isn’t looking to build something to hand down to their kids. They’re not in it for the brand legacy or the emotional connection to the category. They’re in it for the return.

Buy, scale, optimize, and flip.

It’s not about passion, it’s about performance. Franchisees are becoming investors first, operators second and that changes everything.

Passion isn’t a system. Ops is.

In the past, franchise growth was often fueled by owner-operators with skin in the game and hearts in the mission. They invested money from their personal bank account and often spent years working shoulder to shoulder with employees. As a result, when the operational playbook broke down, these franchisees and their owners improvised. If onboarding was clunky, marketing half-baked, or tech inconsistent, it was smoothed over by people who cared. Passion filled in the gaps.

This was the way of the owner-operator, and the dominant archetype in franchises.

But passion doesn’t scale. Especially not in today’s environment.

The rise of the Investor-Optimizers

Franchisees with finance or consulting backgrounds stepped in to take the place once occupied by families and local entrepreneurs. This professional class of founders expects turn-key systems, proven ROI models, and minimal day-to-day complexity. In many cases, they’re running spreadsheets, not shift schedules.

For these investor-optimizers, operational friction isn’t a challenge, it’s a red flag. The more time they spend untangling local marketing, onboarding new staff, or dealing with inconsistent customer experiences, the more likely they are to churn or renegotiate terms.

This is especially true for PE-backed multi-unit operators, who often enter with their own internal KPIs and value-creation timelines. Their priorities? Velocity to breakeven, cost to scale, and ease of exit.

If your brand can’t provide clean, repeatable systems, you’ll lose deals before they ever get to the franchise agreement.

The new breed of franchisees demands a new operational reality

Franchise brands are feeling this pressure acutely. Challenges are solved through the lens of speed and efficiency. You’ll hear questions like:

- “How do we activate new units faster without blowing up our support teams?”

- “How do we allow local flavor in marketing without opening the door to brand chaos?”

- “How do we maintain consistency when ownership is expected to turn over every 3–5 years?”

These aren’t hypothetical. They’re being asked by your future top performers, often backed by institutional capital, and your board is starting to hear the same questions. For franchise owners, the crunch is coming from both sides.

Industries where we see this dynamic in action:

- Fitness and wellness: regional rollups are moving faster than brand compliance can keep up.

- Food and beverage & quick service restaurants: delivery-first models have shifted the customer experience to screens, not stores.

- Home services: digital demand gen matters more than a good logo on a van.

Franchise brands that are growing through today’s capital markets must be ready for the operational expectations that come with investor-backed growth models.

The brands that win make it easy to succeed, and hard to screw up

Leading brands aren’t solving this with more headcount. They’re solving it with better systems. Here’s how top franchisors are adapting:

- Automated onboarding that removes manual handholding and ensures every new hire or franchisee gets trained. Fast.

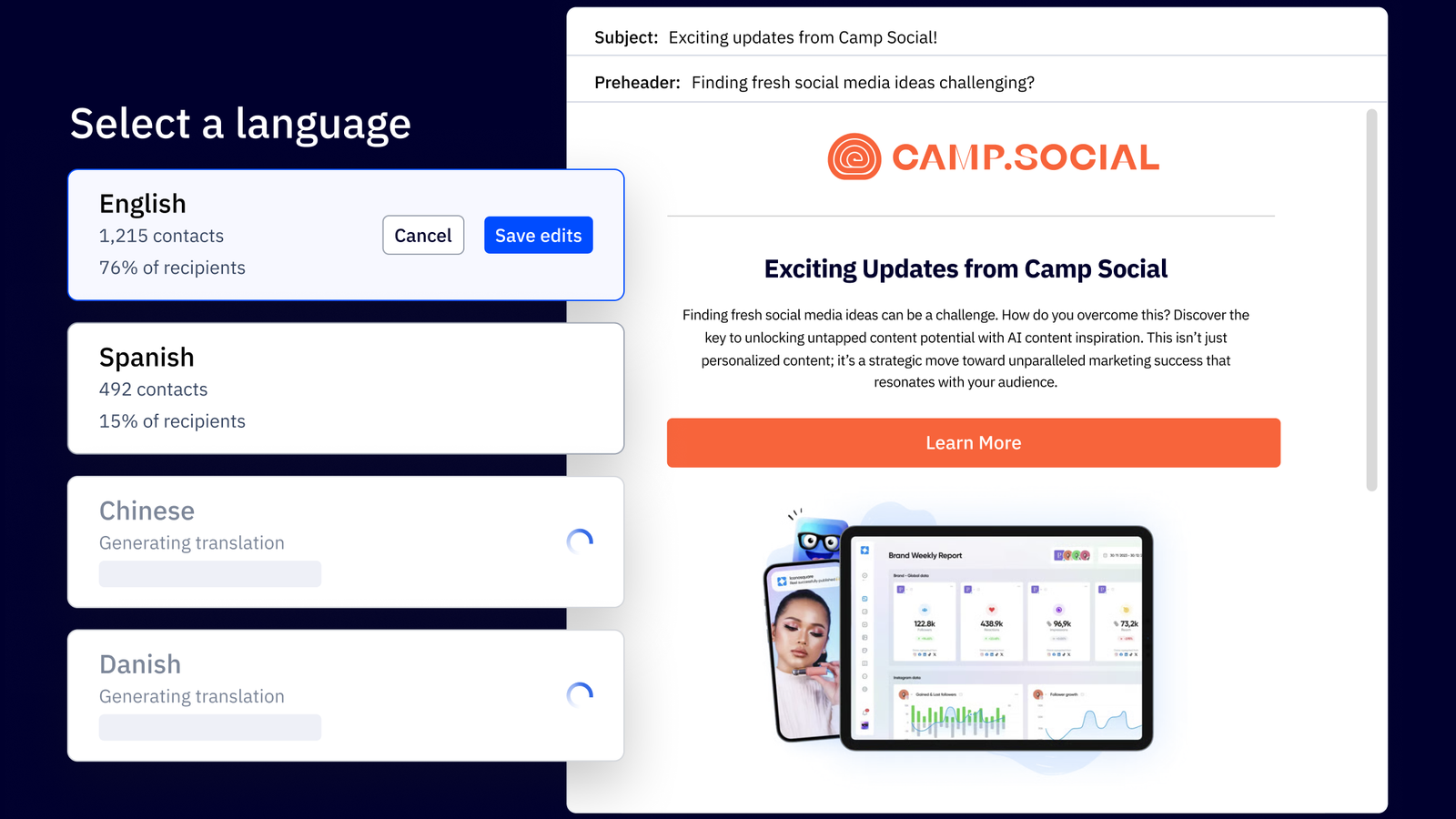

- Marketing automation that centralizes national campaigns, yet empowers local personalization and execution – something 98% of franchise marketers consider important according to our recent industry survey.

- Pre-approved campaign libraries built around real KPIs, not just pretty templates, so franchisees can hit the ground running.

- Permission-based access controls that allow data to be shared responsibly, without putting compliance or customer trust at risk.

That’s exactly what ActiveCampaign HQ is built for.

ACHQ is not just about email marketing or maintaining your CRM. It’s about operationalizing brand equity at scale. A franchisee can step in, follow the playbook, and drive performance without needing daily hand-holding from corporate.

Spending time playing whack-a-mole with marketing campaign issues isn’t just ineffective, it’s a signal to your board and future franchisees that you’re not serious.

In this model, your systems become the brand — more so than any logo or individual campaign.

The ease of your operations is your reputation capital.

What does this mean for franchise executives and investors?

If your brand is growing, or preparing to, it’s not a question of whether you’ll attract investor-franchisees. It’s when.

They are looking at your tech stack. Your playbooks. Your ability to scale without drama. They are benchmarking your ops against best-in-class private equity rollups. And they are making investment decisions accordingly.

If you have aspirations of scaling your concept, you’ll need to decide early on: Are you building a franchise system designed for owner-operators, or investor-optimizers?

You don’t need to pick one over the other. The best brands build an ecosystem that works for both:

- Plug-and-play for the performance-minded.

- Relationship-driven for the community builders.

But you do need to decide on the game you are playing and your response to this enable trend.

Are you going to react to this shift, or start building your systems around it?