In the home services industry, whether you’re managing HVAC, electrical, plumbing, glass and doors, garages, outdoor, or mobile repairs, getting paid can feel like a constant battle. You’re often fronting labor, materials, and time before you ever see a cent.

But here’s the truth: the payment process doesn’t begin with the invoice, it begins the moment a prospect becomes a lead. And when you’re overseeing multiple franchise locations, you can’t afford to leave that process to chance.

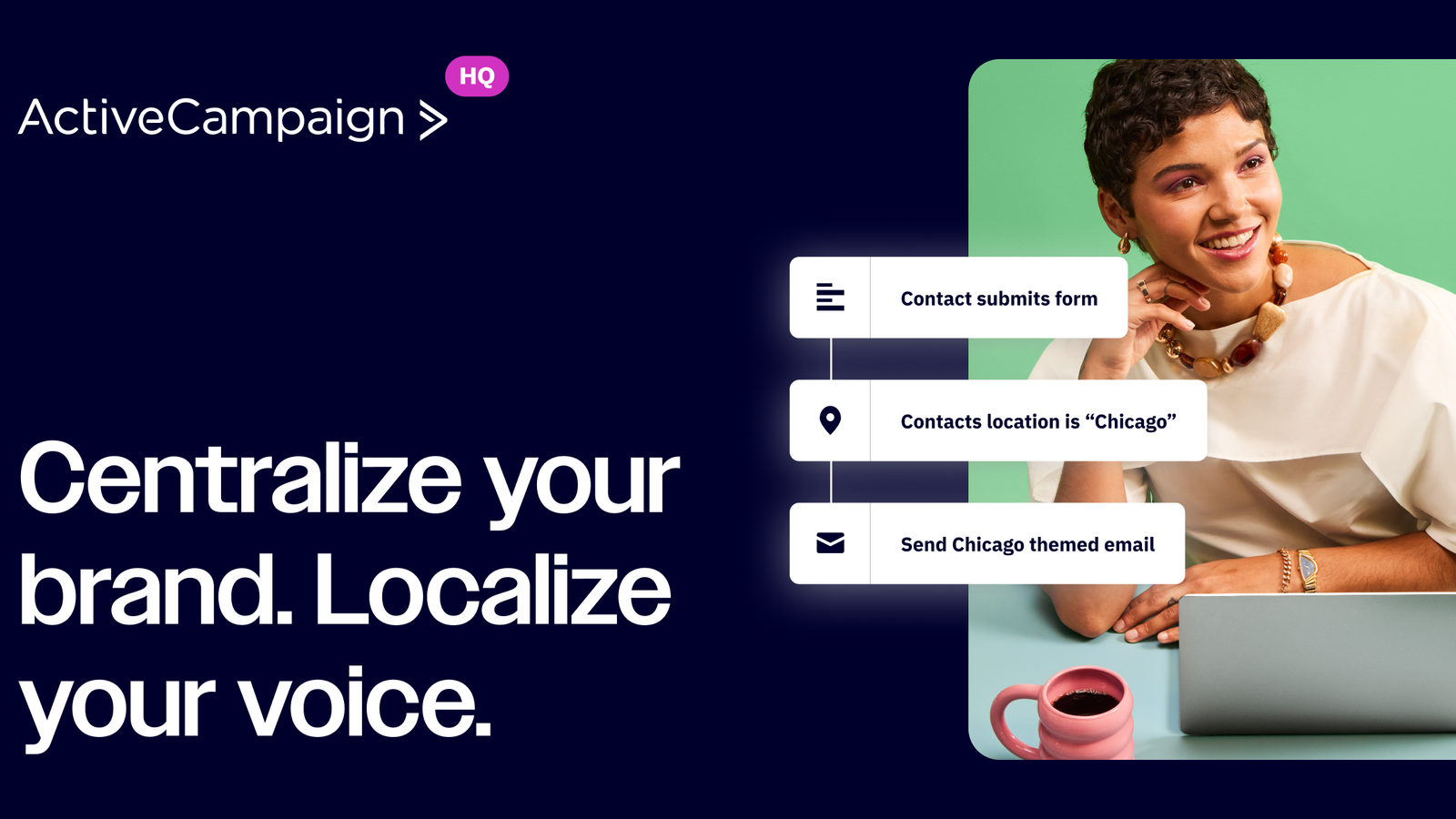

At ActiveCampaign HQ, we partner with service brands that are serious about scaling without the chaos. Automation isn’t just a tech upgrade, it’s how you protect your people, your process, and your profit.

Let’s take a look at how franchisors (and their franchisees) can take control of the payment journey from day one..

1. Start with smart booking and pre-job confirmations

No confirmation? No job. Reduce no-shows and avoid wasting your team’s time with pre-job automation that sets expectations from the beginning.

How automation helps:

- Online forms and CRM sync: Capture appointment requests through web forms or landing pages that auto-sync directly into your CRM. No double entry, no manual errors.

- Terms and conditions (T&C) opt-ins: Use custom fields and checkbox automation to ensure every client accepts your terms before the first visit.

- Automated reminders: Send SMS or email confirmations keep your clients informed and accountable. Brands using these see fewer no-shows.

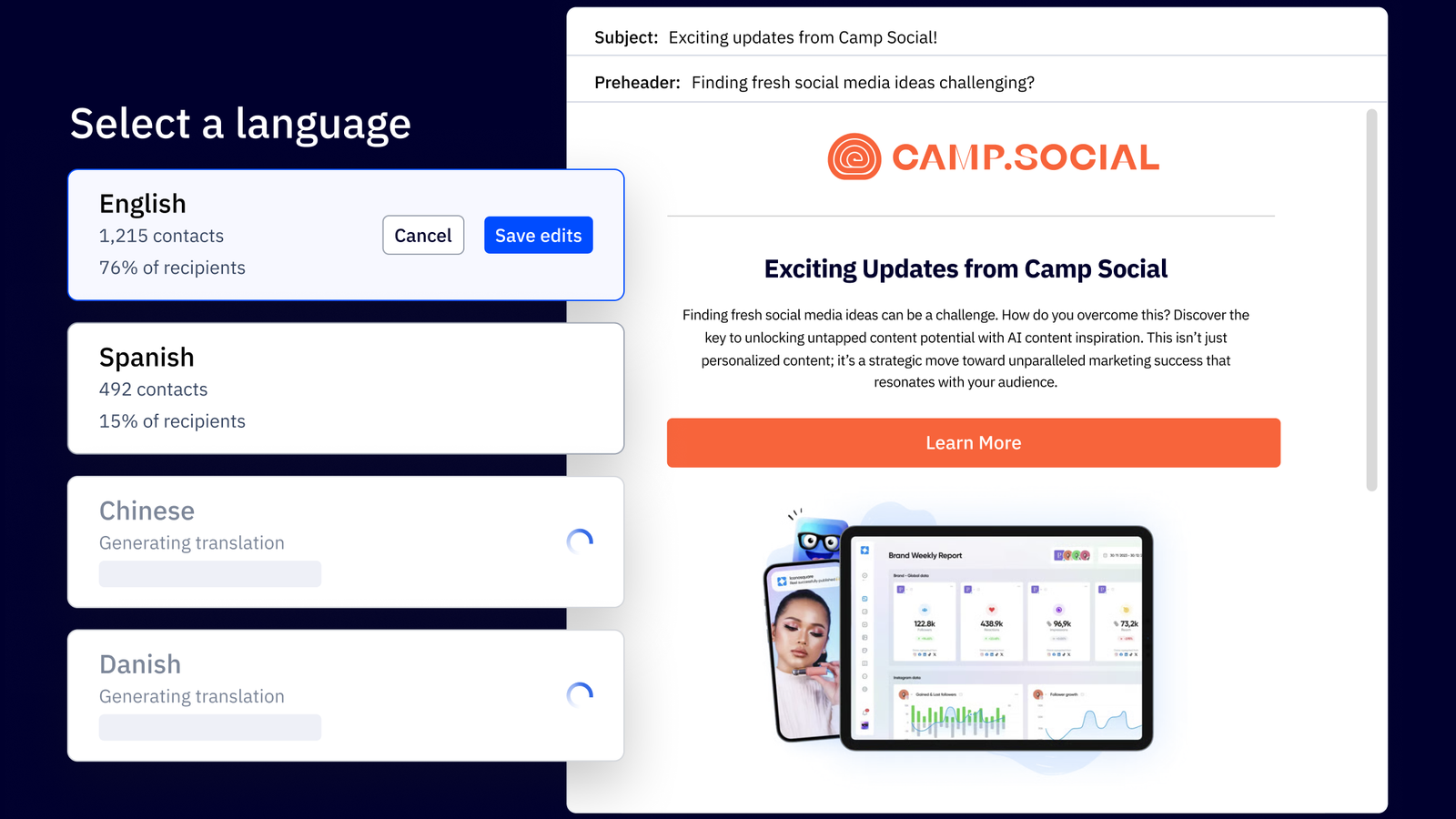

Franchisor tip: ACHQ allows you to localize these workflows across franchise locations, so your brand stays consistent while individual franchisees stay compliant.

2. Use pre-built journeys to enforce payment terms

Set expectations early, and automatically. Talking money upfront can sometimes feel awkward. But it doesn’t have to be. By automating your pre-job communication, you lay the groundwork for timely, dispute-free payments.

Some best practices:

- Trigger educational sequences the moment a booking is confirmed. Include payment timelines, late fees, cancellation policies, and FAQs.

- Share your payment expectations, cancellation policies, and what happens if invoices go unpaid.

- Tag and segment clients based on engagement and behavior (e.g., “Payment Terms Read” or “T&Cs Not Accepted”) to trigger smart follow-ups or even block from proceeding until requirements are met.

Franchisor tip: Use ACHQ to push these sequences to every franchisee, ensuring consistent messaging and reducing legal exposure across your entire brand.

3. Automate invoicing follow-ups like a pro

Don’t “hope” they pay. Automate the chase. Once the work’s done, your focus should be on the next client, not chasing the last one for payment. Automation removes the bottleneck and builds professionalism.

Tactics that work:

- Use CRM-integrated tags to tag when an invoice is sent from your system and start an automated follow-up path immediately.

- Use conditional paths to follow up based on behavior:

- Opened but didn’t pay? Trigger a reminder with a direct payment link.

- Ignored? Send an SMS reminder that communicates urgency.

- Paid? Move them to the “Happy Client” automation and request a review.

Franchisor tip: With ACHQ, you can templatize these automations and deploy them across every location, without every franchisee having to start from scratch.

4. Prepare for non-payment before it happens

Let automation take the emotion out of escalation. Every business eventually deals with non-payment. Instead of reacting to it, create a system that escalates communication in a controlled, professional way.

Build a payment escalation automation with these stages:

- Day 1: Friendly reminder

- Day 3:Follow-up email

- Day 5: Phone call task assigned

- Day 7: Final notice

- Day 10+: Escalate to collections tag

Assign internal tasks, track activity, notify your team, and if necessary, route the contact to your external agency—all without letting it eat up your team’s day.

5. Eliminate common excuses with data and visibility

“He never got the invoice.”

“They’re disputing the amount.”

“They’ve gone silent.”

Automation backed by CRM data gives you full visibility into the customer journey and every interaction that happened along the way.

With ActiveCampaign:

- Track email opens and clicks so you know exactly when someone saw your invoice or terms.

- Attach signed quotes or work approvals to the contact recors for quick reference.,

- Send post-job surveys to capture feedback and timestamp satisfaction before billing.

Franchisor tip: With ACHQ, these data points aren’t just visible to one team, you can report on performance, response times, and payment trends across your entire franchise network.

Bring it all together with ActiveCampaign

Getting paid isn’t about sending an invoice, it’s about building a system that moves every customer smoothly from lead to job completion to final payment. For service business franchisors, that system needs to be reliable, scalable, and easy to replicate across every location.

With ActiveCampaign HQ, you get a centralized platform designed to help you:

- Standardize operations across your franchise network

- Protect your brand with consistent communication

- Automate the full customer journey to reduce admin work

- Improve cash flow with smart, behavior-based follow-ups

- Support your franchisees with ready-to-use templates that actually work

When your systems run on autopilot, your people can focus on what matters: delivering great service and growing the business.

Want to streamline your franchise operations and get paid faster?