In a perfect world, every new buyer you bring into the fold would turn into a lifelong loyal customer. Growing your revenues and profits would be easy with less emphasis on acquiring new customers.

Unfortunately, we don’t live in a fantasy world. Customers often leave for reasons you can’t control, such as no longer needing your service — this is called involuntary customer churn.

In other cases, it’s something you can control — such as a bad experience or your customer preferring a competitor.

This is why it is so important to monitor the number of customers that bail on your business (and why) so you can find ways to keep more of them and consistently grow your revenue.

Or, in more technical terms, you need to improve your customer churn rate.

Below, we’ll explain the importance of keeping an eye on your customer churn and how to find out where you stand. Then, we’ll go over a list of ways to cut your churn and maintain a loyal customer base.

What is customer churn?

Customer churn is when you lose a customer — whether it’s to something you can control or something you can’t. Most businesses use the “customer churn rate” to measure the level of churn among their customers.

The customer churn rate measures the percentage of customers that leave your business over a period of time. Your churn rate is the opposite of your growth rate, which tracks the number of customers coming into your business. Using both formulas together can help you calculate your net customer growth or loss.

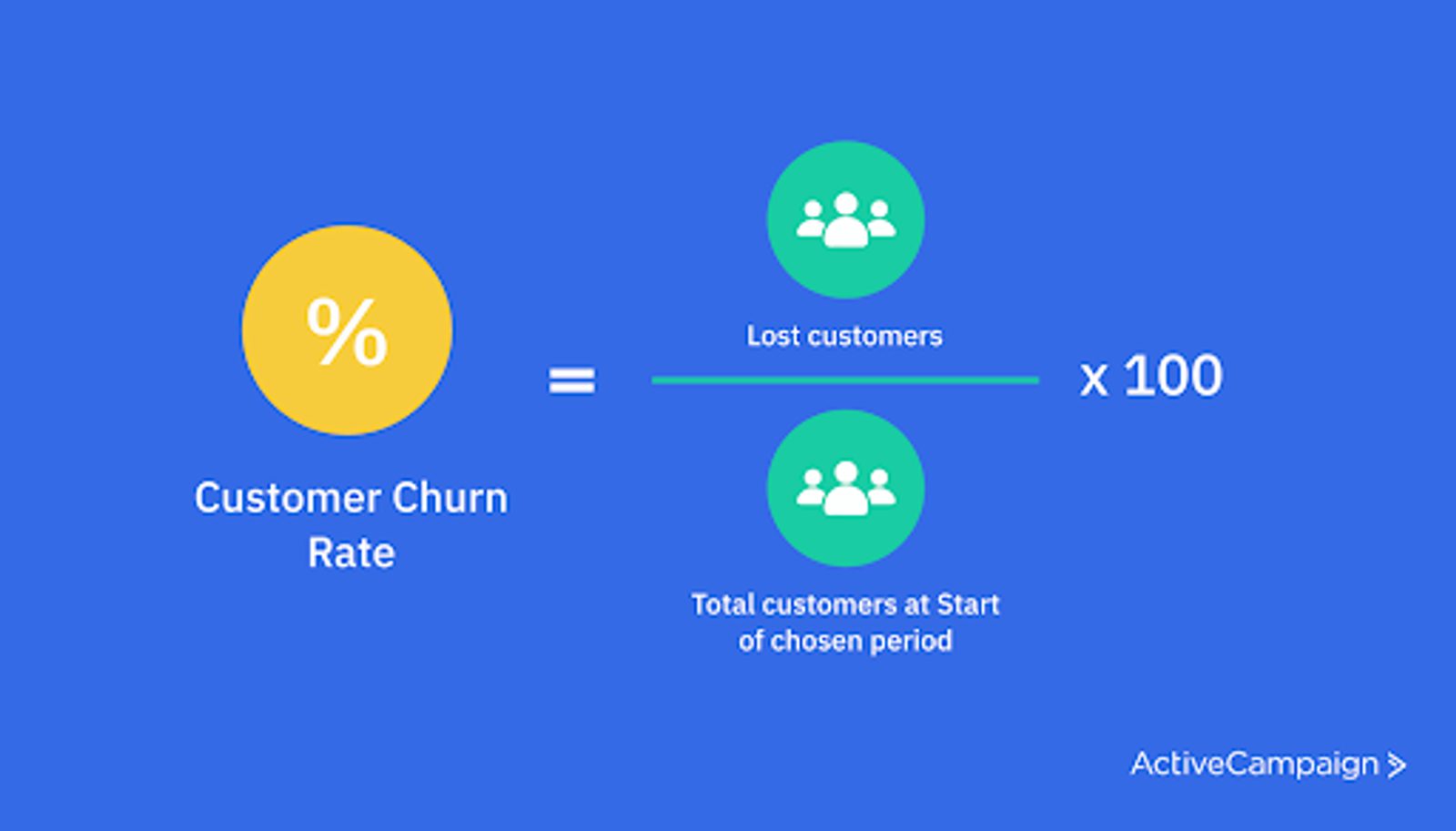

Here’s the churn rate formula for a given period, with the churn rate expressed as a percentage:

Churn Rate % = (Lost customers / Total beginning customers) x 100

For example, imagine you have 100 customers at the beginning of the month. By the end of the month, you have lost five customers.

Plugging our numbers into the formula, we have:

(5 / 100) x 100 = 5% churn rate.

The simple formula offers a look at your customer retention. A lower churn rate means your customers are loyal to your brand. A higher churn rate means you keep a lot fewer of your customers.

How to calculate your customer churn rate

If you want to measure the churn rate in your company, you need to follow this four-step process:

- Figure out exactly how many customers you have at the start of each month, and write that number down.

- Create a list of these existing customers. For example, if you work for a SaaS company, you should be able to sort customers by subscription date. Then sort customers by anyone who started their subscription by the 31st of last month.

- At the end of the month, measure how many of those customers unsubscribed and take note of that number.

- Finally, do the calculations — divide your number of lost customers by your existing ones at the start of the month. Then, multiply that by 100.

Now you’ve got your customer churn rate.

Different types of customer churn

There are two main types of customer churn:

- Involuntary churn

- Voluntary churn

Involuntary Churn

Involuntary churn occurs when factors outside your control cause you to lose customers.

The COVID pandemic is a recent example we’re all familiar with. You can’t do much about a current customer cutting back on their spending during a global crisis.

Another example of involuntary churn is payment failure, which is especially prevalent in SaaS businesses. For instance, a customer’s subscription might end because their card expired or they aren’t signed up for auto-renewal.

Voluntary Churn

Voluntary churn happens when a customer consciously decides to leave your business. For instance, a customer might have a negative experience with your company or prefer a competitor.

You have much more control over your voluntary churn. Make sure to listen to your customers. Improving your products and customer service will help you reduce it.

Why is customer churn rate important?

Your customer churn rate is crucial because it highlights how many customers you lose every month. Minimizing the loss of customers is vital because it’s easier to continue selling to customers already familiar with your brand.

Acquisition is still important, but you’re not as desperate for new business when your churn rate is low. You no longer have to hustle for short-term sales. You free up time and capital to invest in activities that create long-term growth and success.

That allows you to reinvest in customer acquisition and retention efforts, potentially accelerating your growth.

Of course, some customer churn is inevitable, so the best thing you can do is track it and make sure it’s either stable or gradually decreasing.

What is a good churn rate?

A “good” churn rate can vary across industries, so it’s best to compare your churn rate against benchmarks from your industry.

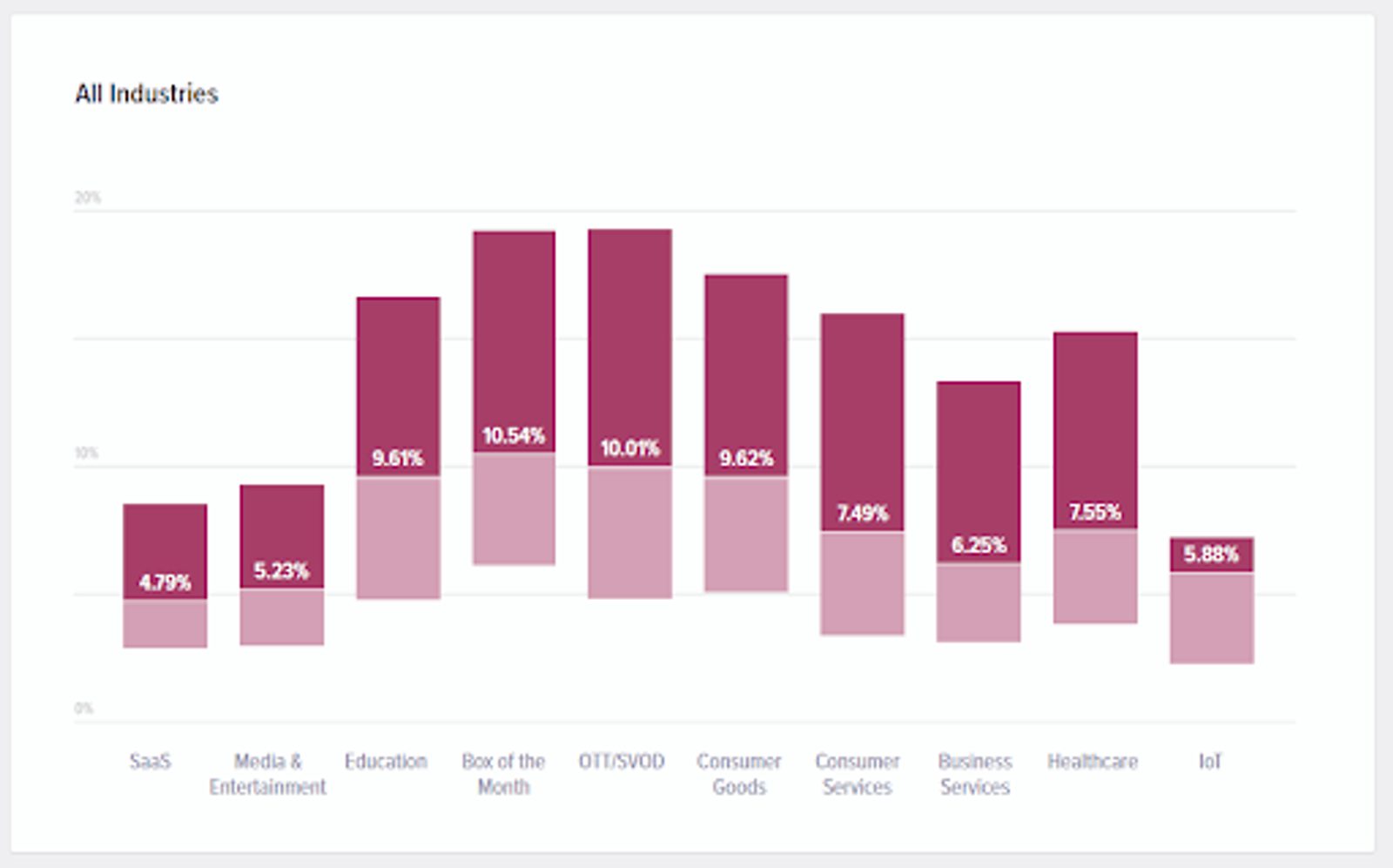

For example, Recurly found that the Software-as-a-Service industry’s average churn rate is about 4.79%. That’s the lowest industry figure they found in their study.

However, the subscription box vertical averaged a 10.54% customer churn, more than double the rate of SaaS companies. So if you’re a subscription box company, a good churn rate could be 6-7%, while as a SaaS company, you should aim for 3% or below.

And it’s not just your industry. Your business’s growth stage also matters. Higher customer churn than your industry average is more acceptable if you’re going through an early high-growth period — you might be shedding a lot of one-time customers as you find that ideal customer.

Your growth is still fast since you’re gaining many more customers than you’re losing. Once your business stabilizes, you need a lower-than-average churn rate to grow. So start focusing on retaining and building long-term relationships with your current customers.

Eight ways to reduce your customer churn rate

Most businesses can benefit from whittling away at their customer churn rate. But doing so will require a broad effort across your entire marketing and sales funnels, onboarding, and customer support.

Here are some tips for cutting your customer churn rate down and keeping your retention high:

1. Make sure you’re targeting the right customers

Your business can’t appeal to everyone. Targeting customers who need what you offer increases the likelihood they buy from and stay loyal to your business.

Researching your customer and creating a solid customer persona is key to creating a smooth customer journey. Aside from demographic information, you’ll want to learn the most significant problems they’re trying to solve, their obstacles to solving those problems, their goals, and similar information.

That attracts customers that truly need what you have, meaning they’ll be less likely to churn. It also helps you craft marketing messages that connect with that audience, improving your acquisition efforts.

Make sure you continue researching your ideal customer and refreshing your customer persona regularly to keep up with market changes.

2. Create a customer roadmap

Some customers churn because they’re confused or overwhelmed about using your product or service.

Creating a customer roadmap can ease the onboarding process. It’ll guide your customer by the hand through your product or service, so they see success using it and stick around.

It also helps you standardize your post-sales process, saving time and making things more predictable.

3. Engage customers with regular emails

In 2019, the Data & Marketing Association found that email marketing earned an average of $42 for every $1 spent in 2019 — a 4,200% ROI. That’s even higher than the 3,200% ROI stat often cited in years prior.

Broadcast emails are the primary tool in your email marketing arsenal. You send these individual emails to your entire subscriber base or relevant customer segments.

They contain content, images, and usually a call-to-action to buy something. CTAs can also nudge readers towards reading or downloading your content.

Some businesses see success with daily emails. Others might only send one per week. You can send newsletters, tips to use your products, or anything else that delivers value to your customers within these emails.

A good email marketing strategy can hook your readers and keep them engaged with your brand. It’s not just lead generation that matters. Lead nurturing is just as important. Luckily, you don’t have to do it all manually — automation can help.

4. Implement email automations

Email automations are a critical piece of business infrastructure. Once you build them, they establish rapport with your audience, keep them engaged, and sell on autopilot.

To maximize the churn-fighting benefits of automations, you’ll need to implement segmentation. This involves splitting your subscribers up based on specific criteria — such as purchase history — to ensure customers get the right emails at the right times.

For instance, you might create a segment for customers that bought from you already to ensure they get an automated email sequence for a different product or service you offer.

Here are some automated emails to consider setting up:

- Upsell and cross-sell sequences: These can trigger when a customer orders a product.Boost each customer’s average order value and solve more of their problems by offering them additional products in the same or other categories.

- Abandoned cart emails: If a customer added something to their cart but didn’t check out, these automated emails can remind them to finish their purchase and capture some sales. You can also use other sales automations to improve the customer experience.

- Reengagement sequences: These can win back customers who appear to have churned after not buying or interacting in a long time.

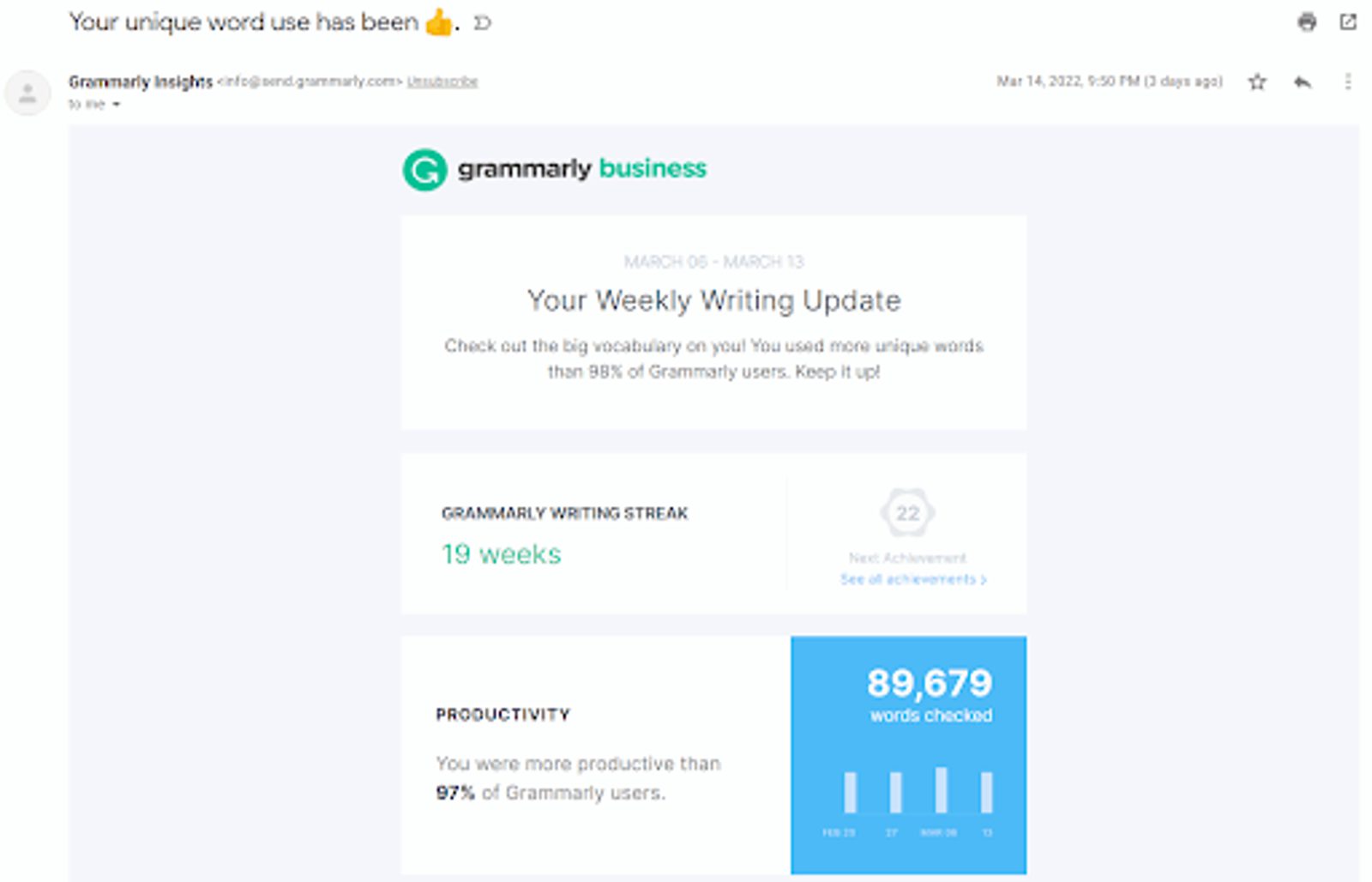

- Usage-based customer engagement or retention emails: By using data from your platform, you can tailor retention emails based on the customer’s product usage and gamify the experience.

Once you set these up, simply monitor their performance and tweak things when necessary.

5. Create loyalty programs

Loyalty programs reward your customers for buying, encouraging them to take advantage by buying even more.

In fact, over half of internet users globally said rewards/loyalty programs are one of the most highly valued parts of shopping — right behind a quick and easy checkout.

Aside from a standard loyalty points or discount program, here’s an idea to create more buzz around your brand:

A “secret” loyalty program that offers above-and-beyond rewards to your top few customers based on their spending with your brand. You wouldn’t make membership info publicly available, making it a pleasant surprise for customers.

When customers get inducted into this secret program, they’ll get genuinely excited to make the most of it.

Plus, you’ll create a buzz among your customer base. The ones that aren’t in the club may keep buying in the hope of better rewards and the exclusivity factor of making it in.

Think of the American Express Centurion Card. The eligibility criteria aren’t clear, which only adds to its exclusivity and eliteness.

6. Improve your customer support

Beefing up the customer support side of your business can reduce churn by a great deal. You can fix dissatisfied customers' problems and make them more likely to stick around.

Customer support can be a struggle for busy solopreneurs and small business owners. You may not have a customer success team to handle these issues.

Implementing email automations and infusing them with some personality and genuineness can help. At the very least, it will show customers you care and working hard to make them happy.

Beyond that, you can hire an assistant to serve as your customer service rep. The increased cost may be worth it if they can cut your churn. Also, make sure your team knows and practices these 25 customer service skills.

7. Get customer feedback

Gathering customer feedback through surveys and reviews helps you understand them better and improve your product or service to match their needs.

But it’s more than that — getting customers involved in your business makes them feel like they have a say. That can keep them engaged over long periods, consistently choosing your brand over alternatives.

8. Monitor and analyze churn

Keeping your eye on your customer churn is key.

Figure out your customer attrition initially, then check in regularly to see if it's improving. Doing so can help you double down on what’s working and pivot away from what’s not.

The pros and cons of customer churn

Customer churn is a helpful metric, but it has a few drawbacks. Make sure you understand its pros and cons:

Pros

- It demonstrates your customer retention levels

- It’s easy to calculate

- It helps you target better customers

- It helps you improve your product and other areas of your business

Cons

- It doesn’t consider what kind of customers are leaving — new vs. long-time customers

- Churn rate isn’t always helpful without the added context provided by your growth rate

- It differs by industry and product type

Combine it with other metrics like customer lifetime value, average order or deal value, and others to guide your campaigns in the right direction.

Start reducing churn rates to kickstart your growth

One-off customers are great, but keeping customers around for the long haul is how you truly grow and stabilize your business. This is why reducing customer churn is crucial to growth.

Customer churn — like any metric — isn’t always helpful in isolation. Using it alongside growth-related metrics gives you a complete picture of your business’s performance.

If you’re struggling to maintain a decent churn rate, explore these examples of marketing automation for customer retention.